California will be forced to pay billions more in pension contributions for government employees after the state retirement system’s decision to lower its assumed rate of return.

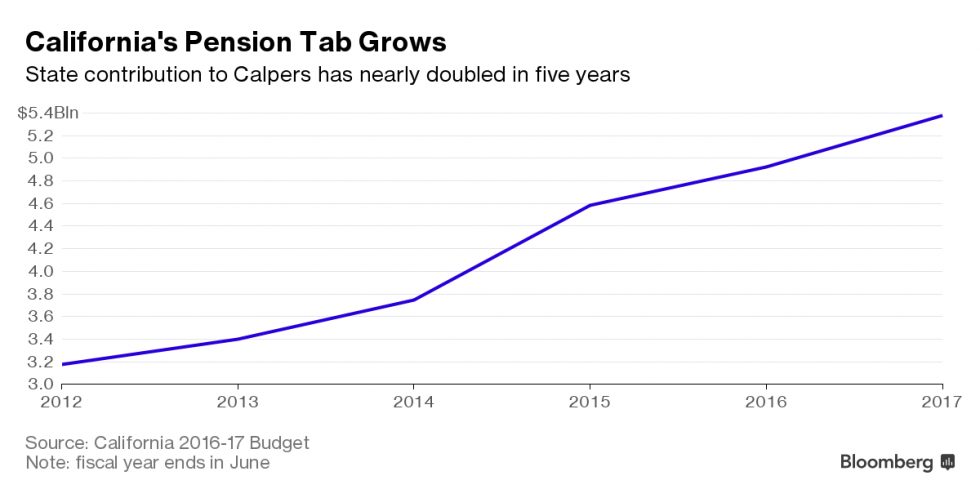

California is already paying $5.38 billion to the California Public Employees’ Retirement System this year, and in fiscal year 2018 the state will need to add at least $200 million more. By fiscal year 2024 the annual tab will increase at least $2 billion from current levels. This all comes on top of increases already scheduled under the system, according to Gov. Jerry Brown’s finance department.

As fixed costs take up a greater portion of the state’s resources, new programs may become more difficult to bankroll. The state is already committed to a progressive minimum wage increase that will cost it $3.6 billion after it reaches $15 an hour in January 2022 and to pay more in matching funds for Medicaid.

While it’s prudent, the lower investment return goal makes California “fiscally more vulnerable” if there’s an economic downturn, says Gabriel Petek, an analyst at S&P Global Ratings in San Francisco. “It’s putting more of an element of risk in the state’s fiscal structure.”

H.D. Palmer, a spokesman for the finance department, says if left unchecked, unfunded obligations could crowd out spending in areas such as education and health-care. Gov. Brown on Dec. 21 hailed the lower investment return target as making the system “more sustainable.”

“It clearly involves additional costs to the state that are significant,” Palmer says. “We’re prepared to incur these costs because the governor has made recognizing and paying down the state’s long-term debt and liabilities a priority.”

California’s revenue is volatile because it draws a large share of taxes from wealthy residents whose incomes are tied closely to the stock market. The top 1 percent of earners — who tend to own shares — accounted for nearly half of the state’s personal income-tax collections in 2014. Voters in November approved a 12-year extension of higher income tax rates on the rich, deepening the reliance on their fortunes.

California stands to benefit from the market’s strong showing, with the S&P 500 Index up 10.62 percent year-to-date. During 2000-2015, the index returned an average of 3.77 percent annually, according to data compiled by Bloomberg.