On the afternoon of Sept. 8, 2011, the thermometer hit a smoldering 115 degrees in San Diego.

Air conditioners were running full blast, and the electrical grid was working hard. To meet the demand, local utilities imported power from Arizona through a substation just west of Phoenix.

At about 3:30 p.m., a worker at the substation accidentally cut power while replacing some equipment. That power failure soon spread. To keep San Diego running, all of the city’s power suddenly had to come through the San Onofre nuclear plant to the north. But the spike in demand overloaded the system. Transformers, transmission lines and generating units started to trip off, creating a cascading blackout.

Eleven minutes after the employee’s mistake, 1.4 million people in Southern California had seen their lights go dark — the largest blackout in California history. It took 12 hours for power to come back in some places. Traffic snarled for hours as stoplights went down. Beaches were shut down after sewage pumping stations created spills. Schools and businesses closed.

The federal government’s major report analyzing the Great Blackout of 2011 identified a key problem: The transmission operators responsible for different grids were flying blind. They didn’t have real-time information about what was going on in neighboring grids — essentials like electricity demand, load limits and the status of other power plants.

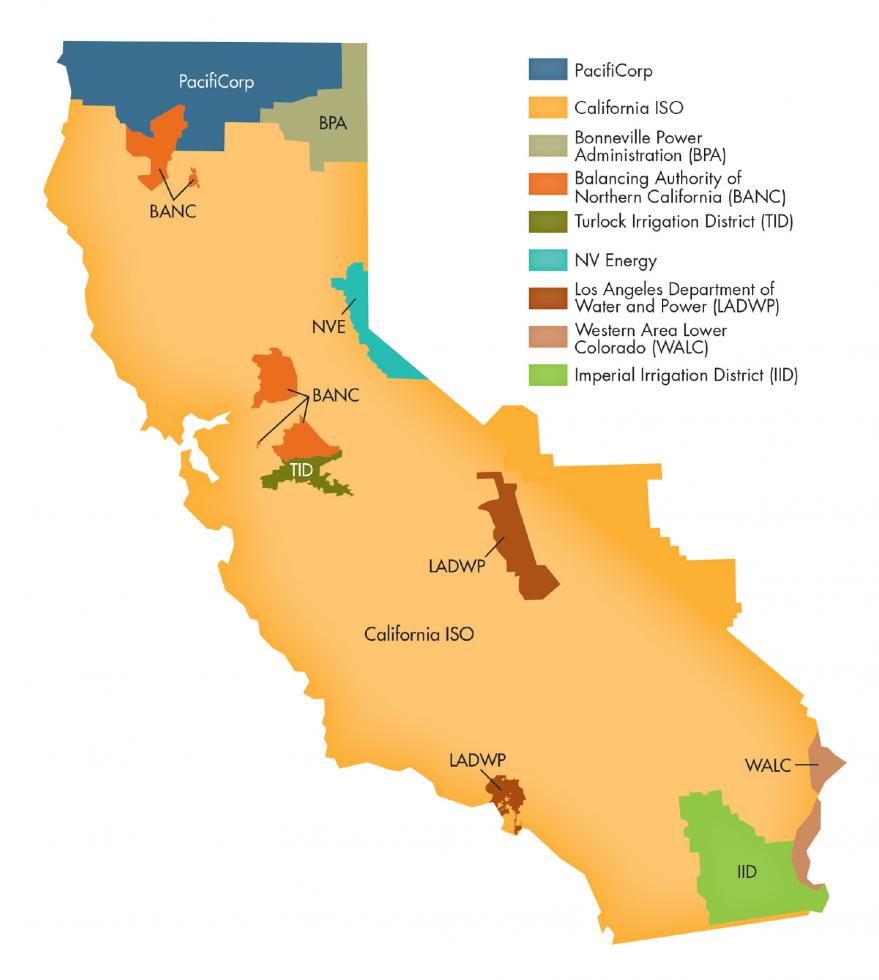

That problem and many others could be fixed by creating a regional power grid for the West, say supporters. This spring, the Folsom-based California Independent System Operator, or Cal-ISO, began an effort to study how a centralized grid for the West would function. But the grid ultimately could incorporate 11 states, some with opposing ideas about how energy should be produced. So skeptics are raising questions about who will decide how it’s run.

“A Bus with 38 Drivers”

Since energy is amorphous, a product that can’t be seen or as yet stored in bulk, a system operator like Cal-ISO doesn’t get much attention until things go wrong. Its job is complicated and critical, and includes projecting the next day’s customer demand, buying power in bulk to meet it, and then making adjustments to actual usage by purchasing same-day power in smaller 5- to 15-minute chunks.

Related: Inside the Cal-ISO Control Room

Draw a line roughly down the eastern boundaries of Montana, Wyoming, Colorado and New Mexico. Cal-ISO is one of 38 system operators for the geographic area that covers everything west of that line. That compares with six system operators responsible for most of the rest of the country. “The divided operation of the western grid is not unlike having a bus with 38 drivers,” noted a recent National Resources Defense Council brief.

In the unconnected system that the West has now, when one operator forecasts that they’ll need to buy power for the next day, they call up a neighboring grid to contract for it. But if it turns out not to be needed, the operator is locked in. “That means a lot of waste, a lot of un-utilized transmission,” says brief author and NRDC’s director of western transmission, Carl Zichella.

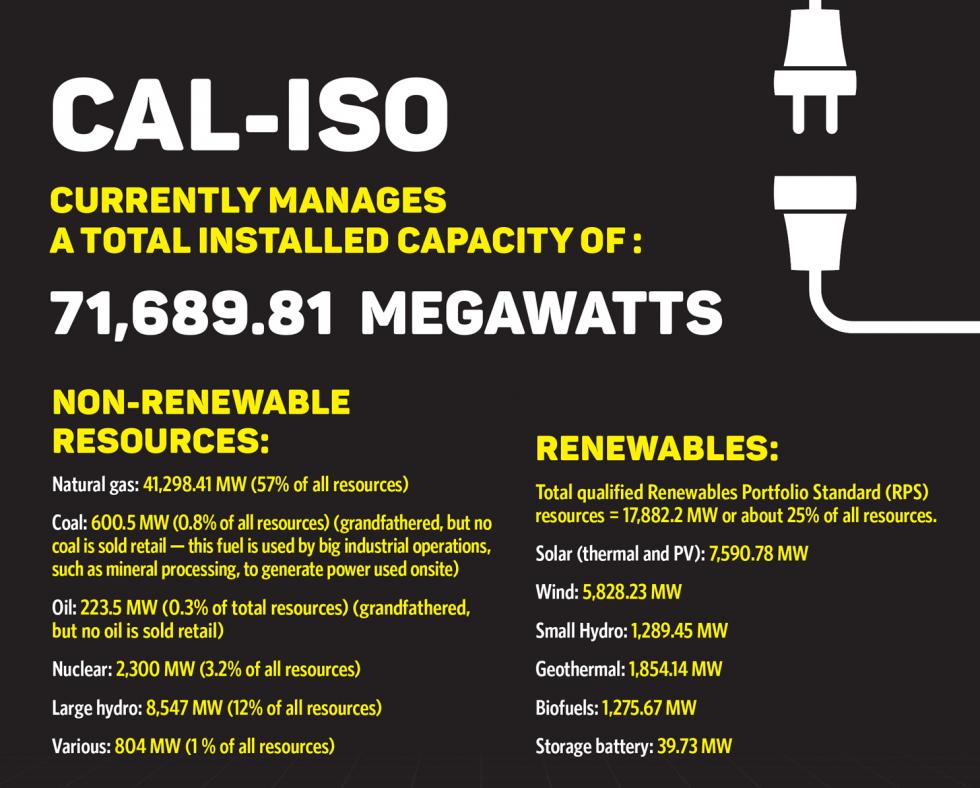

The NRDC supports a western regional grid because it could be critical in California’s bid to derive half the state’s electricity from renewable sources by 2030, mandated by the Clean Energy and Pollution Reduction Act of 2015, or SB 350. (As of 2014, a quarter of the state’s electricity came from renewables.) Hitting that goal may sound like simply a matter of ramping up solar and wind generation. But building more renewable sources won’t be the limiting factor — the fractured western grid could be.

On an average day, solar production is highest in late morning and early afternoon, says Anne Gonzales, senior public information officer at Cal-ISO. But peak energy demand happens at the end of the day when people get home from work or school — just when the sun is going down. Worse, all that excess solar produced during the day can’t be stored — at times, California solar farms have to be shut down to prevent a power surge. Those “curtailments” are going to happen more often as we incorporate more renewable energy, says Gonzales.

Cal-ISO manages 80 percent of California’s electrical grid.

But under a western regional system, that excess solar could be sold to grid operators in other states. When the sun isn’t shining, California could buy wind power from places like New Mexico and Wyoming — whose capacity to produce wind is higher than California’s. That could make it possible to gradually wean off of some of the coal and natural gas plants that come online now to meet California demand when solar can’t.

The Semi-Integrated Grid

The idea of a fully integrated grid didn’t emerge from thin air — Cal-ISO already has partially integrated its system with two other grid operators. Specifically, in November 2014 it launched a same-day market — a market in which electricity is traded in small blocks and used the same day to meet unforeseen demands — with PacifiCorp, a privately owned transmission operator serving parts of California and five other western states. That same-day market is known as an Energy Imbalance Market. And it’s so far produced $65 million in savings, in part because it has allowed less curtailment of renewable power sources, according to an April report from Cal-ISO. That’s making the EIM attractive to other grid operators. Last year, NV Energy, based in Las Vegas, joined. Four others — in Idaho, Oregon, Washington and Arizona — are scheduled to come in by 2018.

Full integration would go further, allowing grid operators, including two in western Canada, to schedule power-sharing in the day-ahead market, where 90 to 95 percent of electricity is sold, Zichella says.

SMUD projections show that participating in a regional grid would cost the utility $20 million to $100 million, causing huge rate hikes.

But the regional grid concept has split the NRDC and Sierra Club California. Kathryn Phillips, director of Sierra Club California, says her group questions the idea of entering into a regional grid agreement in which PacifiCorp is, at least for now, Cal-ISO’s only partner. That’s because in 2015 PacifiCorp generated 62 percent of its power from coal, according to a company fact sheet. “We’re opposed to going into a regional market that doesn’t ensure we’re not creating more greenhouse gas emissions,” says Phillips. Her group cites a May Cal-ISO preliminary study showing carbon emissions a fraction of 1 percent higher in 2020 under a regional grid that includes only Cal-ISO and PacifiCorp versus current practice. By 2030, the study shows carbon emissions declining by at least 3 percent under a regional market versus current practice — but only if additional grid operators join that market, which Phillips contends isn’t a given.

Related: Infographic – More Renewables Coming Online

Since this spring, Cal-ISO has had consultants studying the key impacts of full integration — costs to ratepayers, the environment and the state economy, among others. Most important, they’re looking at governance — who will make policy decisions for a regional grid, if it happens. The timeline for those studies is ambitious. As of May, Cal-ISO was scheduled to present the results of those studies at a meeting of several state agencies by July. Ultimately, the governor and legislature will have to approve any proposal through legislation.

The preliminary results presented in May appeared to point decidedly toward the benefits of a fully integrated regional market. One consultant reported study results projecting that a move to regional integration will cut retail rates of electricity by 2 to 3 percent by 2030. Another concluded that it could produce cascading economic benefits as consumers spend the money they save on the service economy.

While utilities that serve the Sacramento region support integration, only one will participate in any regional grid for now. Pacific Gas and Electric is part of Cal-ISO and so will be a participant in any expansion.

But SMUD won’t be joining, says Chief Assistant General Counsel Steve Lins. SMUD currently belongs to the Balancing Authority of Northern California, another grid operator. SMUD projections show that participating in a regional grid would cost the utility $20 million to $100 million, causing huge rate hikes. That’s because BANC’s transmission costs are less than half of Cal-ISO’s he says — possibly because BANC has an older and therefore less expensive transmission system. “For us it’s not religion, it’s economics,” Lins adds.

Who Will Make Decisions?

But if the regional grid proposal appears to be gaining momentum, there are those who want decision-makers to ensure the state doesn’t get locked into a bad deal. In February, leading Democrats in the state legislature sent a letter to Gov. Jerry Brown asking that key issues be resolved — including ensuring that the grid operator’s decision-makers can’t undermine the state’s groundbreaking new climate policy. That’s a concern because states being added to the grid could include those that aren’t committed to moving away from fossil-fuel power sources.

Nine balancing authorities serve California, more than the entire

western U.S. combined.

That makes picking a governance structure the biggest controversy yet to be resolved. In early May, Cal-ISO convened a workshop to discuss broadly-worded options put forward by the California Public Utilities Commission, public utilities and other experts. One possibility is a governing board composed of technical experts that sets policy, with advice from committees representing different specialties and interests, a kind of governance by technocracy. A second model also would set up a technocratic governing board but also establish a committee of representatives or utility regulators from each participating state. The state committee would be designed to check the power of the governing board, either through a division of the policy areas on which each makes decisions or by giving it veto power over proposals allowed to come before the governing board.

But at press time there was no formal governance proposal on the table, which is why the Democratic legislators wrote their letter. “We want to make sure that it’s a good proposal, an airtight proposal, to protect California’s world-class energy legislation,” says Senate President pro Tem Kevin de León. He worries that under a regional grid, a coal plant could, for example, sue California in federal court over its carbon tax that gets tacked onto power generated from coal or gas plants. Zichella thinks that concern is misplaced — Cal-ISO is already regulated by the Federal Energy Regulatory Commission, so a coal plant could already sue Cal-ISO in federal court, which hasn’t happened. “There’s not a lot of case law that supports the kind of risk that is suggested by that comment … We’ve seen regional system operators help states comply with their renewable portfolio standards,” he says. (de León’s office didn’t respond to a request for further comment.)

It’s not just California politicos who are concerned about governance. Following the May workshop, Gov. Matthew Mead of Wyoming wrote a letter to Gov. Brown expressing concerns about a regional grid’s governance infringing on his state’s sovereignty.

If state policymakers do approve the launch of a regional energy market, its size ultimately won’t be up to California alone, as other states and grid operators have to agree to join. The rapid growth of Cal-ISO’s EIM indicates they will. But in each state and for each grid, that decision will come down to the most important bottom line — what’s in it for them.

Comments

if "markets" are the answer, why will FERC not allow market action:

http://www.rtoinsider.com/berk...

the answer is worth researching ...

The answer is not a bigger grid, it is smaller micro-grids like TID and SMUD.