Latest Stories

Blowing Bubbles

Could Dodd-Frank cause another financial disaster?

The past few years have seen the biggest social upheaval against the banking industry in this nation’s history, and Capitol Hill lawmakers responded with 848 pages of legislation that liberal critics deride as weak and many conservatives call a job killer.

Hunting the Elusive Benefit Package

The endangered benefit plans nears extinction

While much of the local and national talk around pension reform is directed at public employees, the biggest current changes are occurring in the private sector.

Let’s Twist Again

Banks struggle with large debt and minimal borrowers

The Federal Reserve calls it Operation Twist, named after the 1961 Chubby Checker hit that sparked gyrating hips in dance halls across America. That was also the first year the Fed embarked on a mission to purchase long-term Treasury notes in an effort to drive down interest rates on long-term loans.

Past & Present Danger

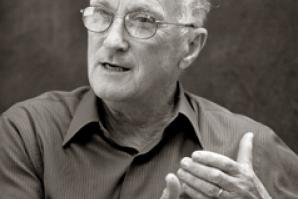

A historied economist imparts warning

Peter Lindert is one of the preeminent voices in the “deep history” field of economics, which looks at the world economy over the scope of all human history. We recently talked with the UC Davis professor about the U.S. and global economies and the penchant for both to experience exhilarating highs and devastating lows.

In Real Estate We Trust

REITs in the new economy

With the real estate market in the tank, many investors are thinking twice about real estate investment trusts, or REITs. And that suits Jim Johnson just fine.

Hedge Hogs

Investors look to recoup losses from the Great Recession

Hedge funds are back. Worries about European debt crisis, war in the Middle East and the potential for rating agencies to downgrade America’s treasuries have rattled shareholders. But those fears haven’t held back investors from pouring record amounts of capital into the cowboy country of largely unregulated, nontransparent funds.

Dilution Solution

The future of retirement for public employees

Looking back, it’s easy to see how some local government pension plans wound up underfunded. As described in last month’s issue, much of the blame goes to generous legislation passed during California’s boom cycles.

Lost and Fund

Counties hold off on muni bonds due to uncertainty

After a jarring sell-off and resulting glut, there’s just one word for today’s municipal bond market: precarious.

Trust Worthy?

Cognitive impairment claims challenge real estate plans

Lesli Pletcher’s parents were not extravagantly wealthy by any stretch of the imagination. However, true to form of a couple raised during the Great Depression, they were frugal and financially cautious so that, by the end of their lives, they had amassed a substantial estate capable of easily sustaining Pletcher’s father in his $9,000-a-month Alzheimer’s care facility.

A Slow Pace?

Some programs for green retrofits remain in limbo

There’s a lot of legal hubbub in California surrounding Property-Assessed Clean Energy programs. Also known as PACE, the programs could be headed for troubled waters.