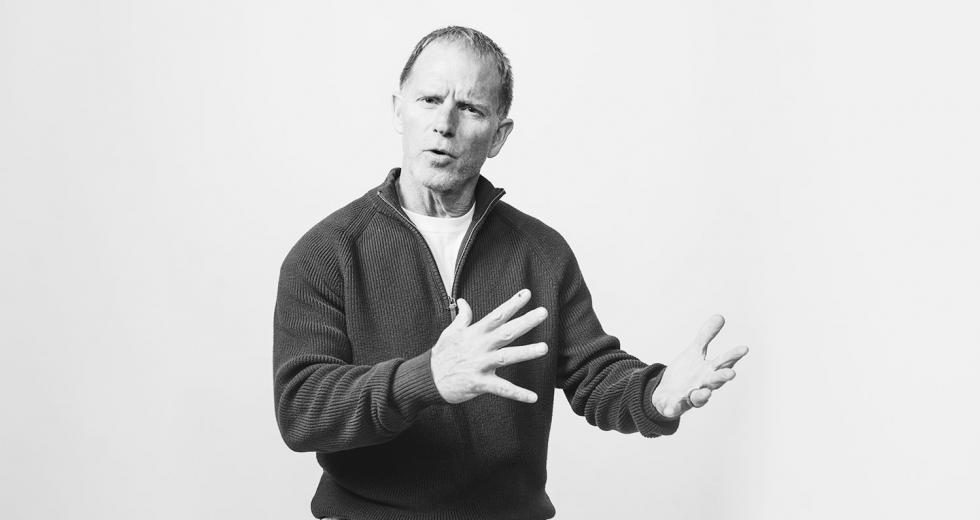

Mark Haney is an entrepreneur, angel investor and host of “The Mark Haney Show” podcast and radio program. He’s also CEO of Rocklin-based HaneyBiz, an investment platform to assist entrepreneurs with resources such as capital and expertise. He says he has founded or funded more than 30 local companies. Comstock’s spoke to Haney about his advice for investors and entrepreneurs.

In addition to being an entrepreneur, you’re an angel investor. What is it about angel investing that motivates you? Basically, why do you do it?

I love angel investing because it is an opportunity to live vicariously through the entrepreneurs that I invest in. I coach football, and I coach baseball, and I have kids and grandkids, and, really, to see one of your entrepreneurial protégées succeed, it’s a little bit like succeeding yourself. It’s pretty much like having one of your athletes do well. One of my favorite entrepreneurs, Jordan Darling, he launched Free Form Factory (an all-electric watercraft manufacturer originally based in Rancho Cordova). I invested money when he was pre-revenue, and today he is part of a company that is a unicorn — (its) value is over $4 billion — and I invested in him when he was at the very beginning stages. He got bought by a company called Nikola (Motor Company), so he has shares in that company, and they’re off to the races.

Another great example is Trifecta Nutrition. I invested in Greg Connolly when he was in his early stages. I brought in advisers and some people to help with the company, including Urijah Faber and Tom Kandris (a local entrepreneur and member of Comstock’s Editorial Advisory Board). That company is the No. 1 organic food delivery company in the nation, based right here in Sacramento. I can’t give you the revenue for the company because the information is not public.

Another one is Jeff Rizzo of Rizknows (a platform for consumer reviews and deals). They’re a company that is just growing like crazy. With these founders, these are people (who) have tremendous potential, and that potential is realized when angel investors come in and give a little help, a little expertise, a little capital.

You talk about investing in founders. How much do you balance investing in the founder, with the company and idea behind it?

It’s virtually all in the founder. I look for the commitment level of the founder and the founding team, but predominantly, I’m looking at the CEO. I’m also looking for a humility level: Are they coachable, do they have a growth mindset? Because an early stage company’s business plan almost always changes, so the founder really needs to be agile and open-minded to how the business might change. … An open-minded person is a heck of a lot more likely to be able to adapt and overcome.

In terms of founders, we have some cautionary tales such as Travis Kalanick of Uber, Adam Neumann of WeWork, etc. What traits should investors steer away from when it comes to a founder?

What one should look for is commitment, and I think track record is huge. One of the things that would maybe be a red flag is when the founder and founding team don’t know each other very well. They haven’t worked together in the past. If they are recently paired up, then the commitment they have to one another is usually not as great, so I definitely look for a founding team that is committed to one another. A good example of that is Jeff Rizzo and Matt Ross with Rizknows. Jeff Rizzo is the founder, and when I came in, he brought on Matt Ross, who is somebody he’s got a great relationship with, and the bond between those two is the key to their success. I do think when a partnership breaks up, that could cause such huge problems that a company might fail.

In terms of investors, angel investing is high risk — how does an investor know when they are ready to take this on?

Typically, an investor is accredited, not always, but typically, which means you need to be making a couple hundred thousand dollars a year and have a net worth of over a couple million bucks. And everybody has to evaluate their own risk tolerance. Since it is risky, it’s not for the faint of heart. If you have a low-risk tolerance, angel investing may not be for you. Even if you have a high-risk tolerance, in most cases it’s probably not the smartest to put 100 percent of your investment dollars into angel investing. You can take a little bit more risk when you’re young, but I think especially as you get older and start to enter into retirement years, I don’t think it would be wise for most people to consider putting a high percentage of their net worth into angel investing, unless their risk tolerance is extremely high. But you can get an outsized return with angel investing. … If you invest in only one startup, (there’s) a lot more risk than taking a little bit and spreading it across 20 or 30 or 40 investments. The chances of having that outsized return will probably go up (if you have multiple investments), because some of these startups will go out of business.

What is your main funding advice for startups?

The best way to raise money is through your customer, and I think that’s something that many startups don’t have enough emphasis on — that first sale, that first taste of revenue. One of the things I advise people is get your product out into the market quickly. Get it out there, hopefully making sales quickly, get customers using it quickly, versus hanging back and waiting to perfect it. So get the minimal viable product out there and begin to drive sales. There’s no problem more sales won’t fix. Really, if you can, bootstrap for as long as you can, raise money from your customers; once you have proven the concept, it will be easier to raise (more) money.

We know that another economic downturn will come. What can startups and entrepreneurs do to be prepared to weather the downturn?

One of the things that … we can do today to hedge against the possibility of a downturn is … outsourcing. Outsource your IT; you can hire an IT person and they demand $100,000 a year, or you can pay somebody a few thousand bucks a month to focus on your IT. You can build your business, especially in the early stages, with less specialists on hand — outsource your IT specialists, outsource your human resources specialist, maybe rent at a coworking space, use outsourced accounting. These are the kinds of things where literally when the downturn comes, you’re not sitting there with an extra several hundred thousand dollars on your payroll that’s really difficult to cut. Instead, you can tweak down some of these expenses. “Maybe I’m going to stop that outsourced bookkeeper and have my wife do it.”

You’ve spoken about the importance of mindset and tapping into one’s killer instincts. What do you mean by that?

I think we all have that innate killer instinct or survival instinct. Tapping into that is sometimes difficult to do, and we end up following the norms of society — we see what everyone else does, and we follow in that method, at that speed, in that way. When, in reality, if we can rise to the occasion, if we can be at our best and really tap into that extra gear we have, that’s how you get better. You don’t get stronger unless you test your limits, and it’s that way in entrepreneurship. … It starts with the right mindset. Your philosophy controls your mindset, which controls your actions, which ultimately control your outcomes. Most of us go through the motions on a daily basis, and we forget to tap into that killer instinct, so we’re left average. … In entrepreneurship, when you’re talking about changing the world, we talk about solving some of these big problems that society has. Well, you’re not going to be able to do it by doing (things) in the same way that everybody else does.

Is there anything else you want to mention?

I’m part of the investor group for the Republic (FC), and today we got a (Major League Soccer) designation. When you think back to when the Kings committed to staying here in Sacramento, and now with the Republic getting its MLS designation, that’s a lot of commitment going on right here in Sacramento, and I think that commitment is infectious, and I think we can expect a lot more development, which means a lot more entrepreneurial activity.

Recommended For You

The Defenders of Small Business

John Kabateck on the myriad challenges facing Main Street, USA

John Kabateck of the National Federation of Independent Business speaks to Comstock’s about tax issues affecting business in California and his organization’s position on Assembly Bill 5.

Bridging Health Care Gaps

WellSpace Health CEO Jonathan Porteus on serving the underserved in our communities

WellSpace has operated since 1953 and provides a range of health care services across nearly three dozen sites in Sacramento, Placer and Amador counties. Comstock’s spoke with CEO Jonathan Porteus about how his organization works to achieve regional health.

Chamber Challenge

El Dorado County Chamber of Commerce CEO on issues facing businesses in its rural communities

Comstock’s spoke with Laurel Brent-Bumb, CEO of the El Dorado County Chamber of Commerce, about efforts to make this largely rural region a desirable place to do business.

Pathway to the Future

Los Rios Community College District Chancellor Brian King on new opportunities — and new funding

Comstock’s recently spoke with King (who is also a member of our editorial advisory board) about challenges faced by community college students and how Los Rios can help train the workforce of the future.